Table of Contents

- Executive Summary: 2025 Snapshot & Market Trajectory

- Microgravity Bioreactor Technologies: Core Designs & Breakthroughs

- Key Players & Pioneering Projects (NASA.gov, ESA.int, SpaceX.com, MadeInSpace.us)

- Market Forecasts Through 2030: Growth Drivers & Valuation

- Applications: Pharmaceuticals, Tissue Engineering, and Industrial Biotech

- Space vs. Terrestrial Bioreactors: Comparative Analysis

- Investment Landscape: Funding Rounds, Partnerships, and M&A Trends

- Regulatory Environment & International Collaboration (NASA.gov, ESA.int)

- Technical Challenges: Scale-Up, Automation, and Quality Control

- Future Outlook: Next-Gen Bioreactors and the Path to Commercialization

- Sources & References

Executive Summary: 2025 Snapshot & Market Trajectory

Microgravity bioreactor engineering stands at the forefront of space-based biotechnology innovation in 2025, with the sector rapidly advancing from experimental research towards scalable commercial applications. The unique environment of microgravity, primarily accessed through platforms like the International Space Station (ISS), enables the cultivation of biological products—ranging from organoids and stem cells to advanced pharmaceuticals—under conditions unattainable on Earth. This has catalyzed a surge of interest and investment among public and private stakeholders seeking novel biomedical and industrial breakthroughs.

A pivotal year in this trajectory, 2025 will see several key milestones. NASA continues to support microgravity bioreactor research via the BioFabrication Facility, enabling the development of 3D tissue constructs with potential therapeutic and pharmaceutical applications. Meanwhile, Redwire Corporation is expanding its partnerships and technical capabilities to scale up biofabrication processes aboard the ISS, focusing on tissue and organoid production that could revolutionize regenerative medicine.

- Commercialization Pace: Companies like SpacePharma and Techshot (a Redwire company) are actively deploying automated, miniaturized bioreactor platforms for both pharmaceutical and biologic manufacturing. Their systems are designed for remote operation and high-throughput experimentation, addressing the growing demand for efficient, reproducible microgravity bioprocessing.

- Industrial Partnerships: Ongoing collaborations between biotech firms and space infrastructure providers—such as Axcelfuture and Nanoracks—are streamlining the pathway from research-grade bioreactors to commercial-scale production modules. These collaborations are expected to accelerate the translation of laboratory results into viable, market-ready products within the next two to five years.

- Market Drivers & Outlook: The sector’s momentum is underpinned by increasing demand for advanced therapies, precision medicine, and a sustainable supply of biological materials. As more permanent orbital and lunar facilities come online (including contributions from NASA and international partners), the market for microgravity-enabled bioprocessing is projected to expand significantly, attracting new entrants and investment.

Looking ahead, the trajectory through the late 2020s is defined by scaling challenges and regulatory considerations, but also by transformative potential. As bioreactor engineering matures in microgravity, it is poised to reshape sectors as diverse as pharma, tissue engineering, and cellular agriculture, with 2025 marking a critical inflection point for both technological validation and commercial acceleration.

Microgravity Bioreactor Technologies: Core Designs & Breakthroughs

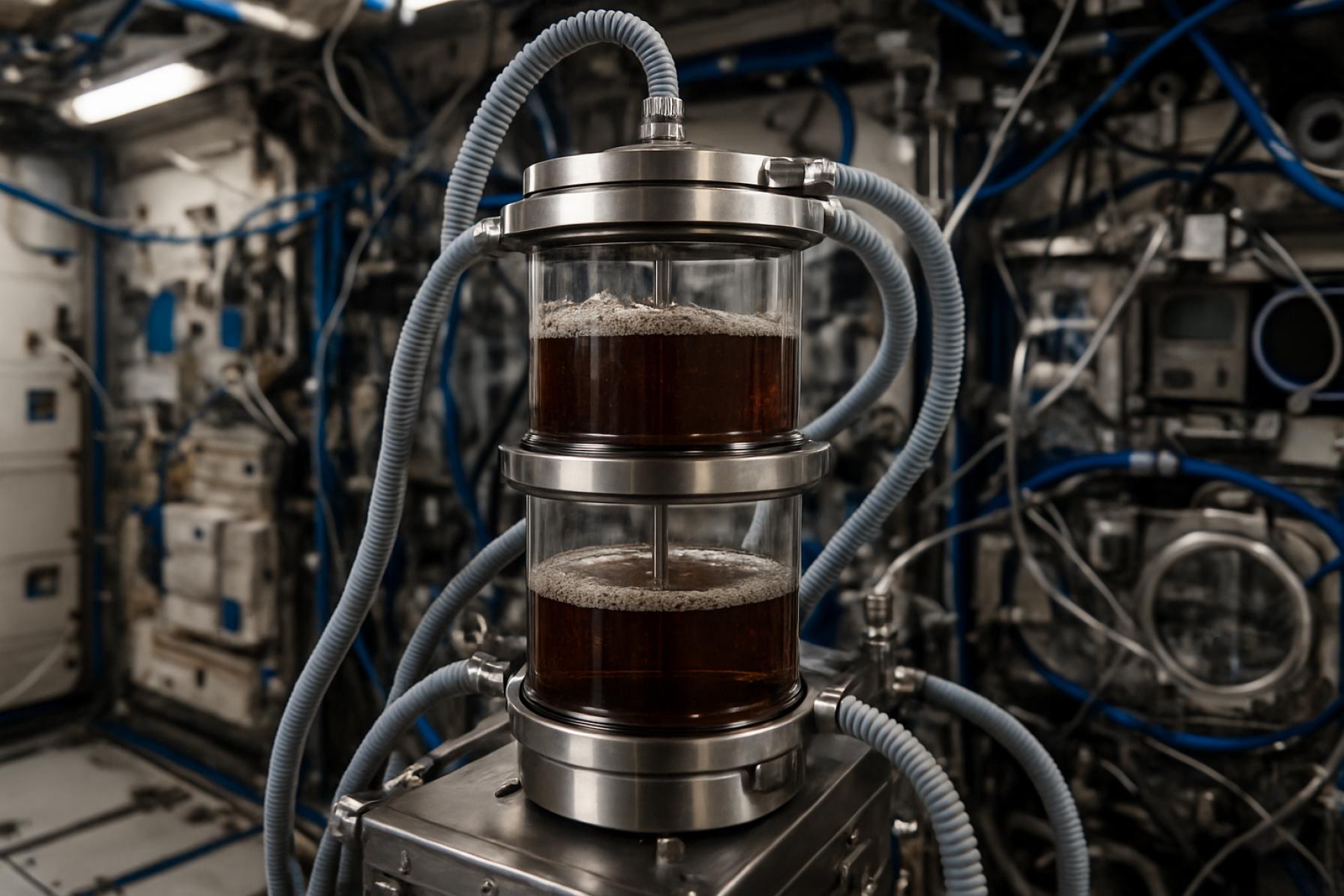

Microgravity bioreactor engineering has rapidly advanced by leveraging the unique environment of space to optimize cell culture, tissue engineering, and biomanufacturing processes. In 2025, several core bioreactor designs are shaping the sector: rotating wall vessels (RWVs), perfusion bioreactors, and modular, automated systems specifically adapted for microgravity.

One of the most widely used designs is the rotating wall vessel, originally developed by NASA in the 1990s. The National Aeronautics and Space Administration (NASA) has continued to refine these systems for modern spaceflight, introducing improved fluid management and gas exchange mechanisms. For instance, the BioNutrients experiment, launched to the International Space Station (ISS), utilizes a bioreactor module to cultivate beneficial microbes, demonstrating robust viability and productivity under microgravity conditions.

Perfusion bioreactors are also gaining traction. In 2024, Redwire Corporation successfully operated their BioFabrication Facility (BFF) aboard the ISS, using perfusion-based techniques to support the growth of complex tissue structures. The BFF’s modular design allows for automated nutrient delivery and waste removal, key for long-duration experiments and eventual clinical applications. The company has announced plans to upgrade the facility in 2025, with new automation features aimed at enhancing scalability and reproducibility for pharmaceutical and regenerative medicine research.

Automated, modular bioreactor platforms are emerging as a transformative trend. Tecan Group is collaborating with space agencies to adapt its laboratory automation technologies for microgravity, focusing on closed-loop monitoring and remote operation. These systems aim to standardize biomanufacturing in space, reducing crew workload and improving experiment consistency.

Material selection and in situ resource utilization are also areas of breakthrough. Airbus and partners have developed bioreactor-compatible 3D bioprinting materials verified on the ISS, supporting the integration of tissue constructs and organoid cultures. This foundational work is expected to contribute to future lunar and Martian biomanufacturing initiatives.

Looking ahead to the next few years, the focus is on scaling up production, enhancing automation, and integrating AI-driven controls for real-time process optimization. Companies such as Sierra Space are planning to deploy next-generation biomanufacturing modules on commercial space stations, targeting continuous production of therapeutics and personalized medicine components. As private and governmental investment grows, microgravity bioreactor engineering is poised to redefine bioprocessing both in space and for terrestrial applications.

Key Players & Pioneering Projects (NASA.gov, ESA.int, SpaceX.com, MadeInSpace.us)

The field of microgravity bioreactor engineering is rapidly evolving, with several key organizations driving innovation in both space-based biomanufacturing and life sciences research. In 2025 and the coming years, collaborations between governmental agencies and private companies are accelerating the deployment of advanced bioreactor systems aboard orbital platforms and preparation for lunar and Martian habitats.

- NASA continues to lead foundational research in microgravity bioreactor technologies, focusing on regenerative life support, tissue engineering, and microbial cultivation for long-duration missions. The agency’s Advanced Plant Habitat and BioNutrients projects aboard the International Space Station (ISS) have demonstrated controlled-environment bioreactor operation in microgravity, supporting both food production and pharmaceutical synthesis. In 2025, NASA is advancing the “BioFabrication Facility,” which enables automated bioprinting of tissue constructs in space—a critical step toward on-demand organ and tissue engineering for future deep space exploration (NASA).

- The European Space Agency (ESA) has established itself as a significant contributor through its MELiSSA (Micro-Ecological Life Support System Alternative) program, a closed-loop bioreactor system designed for sustainability in space habitats. In 2025, ESA is scaling up MELiSSA’s ground demonstrators and advancing plans for in-orbit experimentation, targeting resource recycling and bioregenerative life support for lunar bases. ESA’s partnerships with European biotech firms are also focusing on optimizing microbe-driven bioprocesses under microgravity, with the aim of enhancing biomass yield and metabolic stability (European Space Agency (ESA)).

- SpaceX is providing key infrastructure through regular ISS resupply missions and the development of private space stations with partners like Axiom Space. These commercial platforms are expected to host a new generation of microgravity bioreactor payloads for pharmaceutical, nutraceutical, and materials R&D. In 2025, SpaceX’s Crew Dragon and Cargo Dragon vehicles are supporting rapid return and deployment of sensitive biological samples, enabling iterative development of bioreactor designs and real-time analysis (SpaceX).

- Made In Space (now a part of Redwire Space) is pioneering in-situ manufacturing and bioprinting technologies. Their “BFF” (BioFabrication Facility) aboard the ISS, developed in collaboration with NASA and Techshot, is designed to 3D print biological tissues and, in future iterations, potentially entire organs. Continuous improvements to this platform throughout 2025 aim to refine cell culture techniques and scalability, with direct implications for regenerative medicine in space and remote terrestrial environments (Made In Space / Redwire Space).

Looking ahead, these organizations are expected to transition from proof-of-concept demonstrations to routine, scalable bioprocessing in orbit. The coming years will likely see integration of AI-driven automation, closed-loop nutrient recycling, and modular bioreactor architectures, enabling more robust and diverse biological manufacturing in microgravity settings.

Market Forecasts Through 2030: Growth Drivers & Valuation

The microgravity bioreactor engineering sector is poised for dynamic growth through 2030, driven by increasing investments in commercial space infrastructure, biomanufacturing innovation, and space-based life sciences. In 2025, the market is being shaped by demand from pharmaceutical, regenerative medicine, and advanced materials companies seeking to exploit the unique properties of microgravity for improved cell culture, tissue engineering, and protein crystallization.

Key players such as NASA, European Space Agency (ESA), and private firms like Redwire Space and Sierra Space are actively advancing in-orbit bioreactor platforms. For example, as of 2025, Redwire’s BioFabrication Facility has completed multiple tissue engineering experiments aboard the International Space Station (ISS), demonstrating the ability to produce complex 3D tissue constructs in microgravity environments. Meanwhile, Airbus continues to expand its Bioreactor Express Service, enabling commercial and research payloads for cell biology and bioprocessing on the ISS.

Market momentum is also fueled by partnerships between biopharma companies and space technology providers. Axiom Space and SpacePharma are developing modular microgravity bioreactor systems, targeting both research and commercial production. These collaborations are expected to accelerate in the coming years as new commercial space stations and free-flying laboratories, such as those developed by Sierra Space and Blue Origin, come online.

Financially, the microgravity bioreactor market is anticipated to achieve compounded annual growth rates (CAGR) in the double digits through the decade, as indicated by direct industry announcements and deployment milestones. The entry of private capital, such as Redwire Space’s public listing and infrastructure expansion, signals growing investor confidence. By 2030, the sector’s valuation is expected to reach several billion dollars, underpinned by increasing utilization rates of orbital platforms and the broadening of application fields from pharmaceuticals to food tech and biomaterials.

- Expansion of commercial space station capacity (e.g., Axiom Space, Sierra Space)

- Growth in demand for microgravity-enabled biologics and advanced materials production

- Continuous innovation in scalable, automated bioreactor technologies (Airbus Bioreactor Express)

- Government and international agency support for space-based biotech R&D (European Space Agency, NASA)

Overall, the outlook through 2030 is robust, with the microgravity bioreactor engineering market set to benefit from technological advances, diversified funding sources, and the roll-out of dedicated commercial space infrastructure.

Applications: Pharmaceuticals, Tissue Engineering, and Industrial Biotech

Microgravity bioreactor engineering is rapidly transforming applications across pharmaceuticals, tissue engineering, and industrial biotechnology. The unique environment of microgravity—available on platforms such as the International Space Station (ISS)—enables cell cultures and bioprocesses that are difficult or impossible to replicate on Earth, particularly for high-value products.

In the pharmaceutical sector, microgravity bioreactors are enabling more precise protein crystallization and accelerated drug development. The absence of sedimentation and convection currents in microgravity leads to larger and more well-ordered crystals, which are critical for structural biology and rational drug design. In 2023, Merck & Co., Inc. continued its collaborative research with NASA, advancing the crystallization of monoclonal antibodies on the ISS, with the goal of improving drug formulation and efficacy. These efforts are expected to expand into 2025, with further bioreactor-based experiments planned to optimize crystallization conditions for next-generation therapeutics.

Tissue engineering stands to benefit significantly from microgravity bioreactors, especially for culturing three-dimensional tissues and organoids. In 2024, Techshot, Inc. (a division of Redwire Space) and Redwire Corporation successfully used their BioFabrication Facility (BFF) onboard the ISS to 3D-print human knee meniscus tissue constructs. The microgravity environment facilitates the assembly of complex tissue structures, reducing gravitational stress that often leads to structural collapse or cellular stratification on Earth. Over the next few years, the focus is expected to shift towards scaling up the production of more complex tissues, such as cardiac and liver constructs, with an eye toward clinical translation and eventual transplantation.

Industrial biotechnology applications are also emerging. Microgravity bioreactors provide a platform for growing microorganisms and producing bio-based chemicals with altered metabolic profiles. Airbus has partnered with several biotech firms to investigate fermentation and enzyme production in microgravity, leveraging the ISS’s Biolab and external payload platforms. These projects are exploring the potential for improved yields, novel bioactive compounds, and reduced contamination, with pilot-scale studies scheduled through 2025.

Looking forward, the commercialization of microgravity bioprocessing is poised to accelerate. Companies such as SpacePharma are deploying autonomous microgravity bioreactor platforms that allow Earth-based clients to remotely run experiments in orbit, democratizing access to microgravity R&D. As commercial space stations—like those planned by Axiom Space—come online, the capacity for routine, scalable biomanufacturing in microgravity will increase, fueling innovation in drug development, regenerative medicine, and sustainable industrial bioprocesses through the remainder of the decade.

Space vs. Terrestrial Bioreactors: Comparative Analysis

The comparative analysis of space-based (microgravity) versus terrestrial bioreactors has gained significant momentum as commercial and governmental space operations expand in 2025. Microgravity environments, such as those aboard the International Space Station (ISS) or planned low Earth orbit (LEO) platforms, offer unique physical conditions—minimized sedimentation, altered fluid dynamics, and reduced shear stress—that affect cell culture, tissue engineering, and biomanufacturing outcomes in ways not replicable on Earth. These differences have prompted active research partnerships and pilot projects aiming to optimize bioreactor designs for both environments.

For instance, NASA continues to support microgravity bioreactor experiments on the ISS National Laboratory, focusing on stem cell proliferation and three-dimensional tissue assembly. In 2024 and 2025, the agency sponsored studies using rotating wall vessel (RWV) bioreactors to produce cartilage and cardiac tissues with enhanced structural fidelity compared to Earth-based controls, highlighting microgravity’s potential for regenerative medicine.

Meanwhile, commercial entities such as Redwire Corporation have deployed advanced biomanufacturing payloads to the ISS, including the BioFabrication Facility (BFF), which successfully printed human knee menisci and cardiac tissues in microgravity in 2023–2025. These results show microgravity’s advantages in reducing scaffold collapse and improving nutrient diffusion, factors that terrestrial bioreactors struggle to overcome without complex mechanical interventions.

On the terrestrial side, companies like Eppendorf SE and Sartorius AG lead in commercial bioreactor systems with advanced automation and process control, offering consistent scalability for pharmaceuticals, cell therapies, and cultured meat production. However, these systems face limitations in precisely mimicking the microenvironmental conditions of space, especially for delicate tissue structures.

Data from recent ISS experiments suggest that cell aggregates and organoids grown in microgravity exhibit more physiologically relevant morphology and gene expression profiles than those cultured terrestrially. Yet, challenges remain: space-based bioreactor operations must overcome limited crew time, constrained volume, and the need for remote monitoring and process automation. Industry players like Airbus Defence and Space are actively developing compact, automated bioreactor modules tailored for orbital deployment, with anticipated broader demonstrations in 2025–2027.

Looking forward, the synergy between terrestrial and microgravity bioreactor engineering is expected to accelerate, as findings from space prompt design improvements in Earth-based platforms and vice versa. As commercial LEO stations and microgravity research facilities come online, the comparative performance data will inform both biomedical and industrial applications, reinforcing the complementary roles of both environments in advancing bioprocessing technology.

Investment Landscape: Funding Rounds, Partnerships, and M&A Trends

The investment landscape for microgravity bioreactor engineering in 2025 is marked by heightened interest from both public and private sectors, as the promise of advanced tissue engineering, regenerative medicine, and biomanufacturing in space becomes more tangible. Key players are securing significant funding, forging strategic partnerships, and engaging in mergers and acquisitions (M&A) to consolidate expertise and accelerate commercialization.

- In early 2025, Redwire Corporation announced the expansion of its in-space biomanufacturing initiatives after securing additional capital from a consortium of institutional investors. This funding aims to scale Redwire’s 3D bioprinting and bioreactor payloads aboard the International Space Station (ISS), targeting pharmaceutical and regenerative medicine applications.

- Axiom Space has continued to attract strategic partnerships, including a 2025 collaboration with Concurrent Technologies Corporation to co-develop modular microgravity bioreactor systems. The partnership focuses on leveraging Axiom’s private orbital platform (scheduled for initial modules in the mid-2020s) to host commercial-grade biomanufacturing facilities.

- Nanoracks (now part of Voyager Space) expanded its Outpost program in 2025 by acquiring a minority stake in a leading microgravity bioreactor startup. This move strengthens Nanoracks’ portfolio in biofabrication and positions it to serve pharmaceutical clients looking to exploit microgravity for high-value biologics.

- SpacePharma completed a Series C funding round in early 2025, securing investments from both traditional venture capital and strategic industry partners. The capital will be used to scale its miniaturized, remotely operated bioreactor platforms for deployment across multiple low Earth orbit (LEO) stations.

- National agencies, including NASA and the European Space Agency (ESA), continue to support microgravity biotechnology through grant programs and public-private partnerships. In 2025, NASA increased funding for its BioFabrication Facility on the ISS, inviting proposals for commercial microgravity bioreactor payloads and fostering new industry-academic consortia.

Looking ahead, the outlook for investment in microgravity bioreactor engineering remains robust. With the upcoming operationalization of commercial space stations and increasing demand for space-enabled biomanufacturing, the sector is poised for further capital inflows, cross-sector partnerships, and potential M&A activity as companies seek to scale and diversify their offerings.

Regulatory Environment & International Collaboration (NASA.gov, ESA.int)

The regulatory landscape and international collaboration for microgravity bioreactor engineering are evolving rapidly as space agencies and private entities intensify their efforts to harness unique space environments for biomedical and biomanufacturing breakthroughs. In 2025, regulatory frameworks are increasingly shaped by the dual imperatives of safety and innovation, while collaborative programs underpin both technology development and operational deployment aboard platforms such as the International Space Station (ISS).

The United States, under the stewardship of NASA, continues to develop and refine safety and operational guidelines for bioreactor payloads on the ISS and future commercial space stations. In 2024, NASA introduced updates to its Biological and Physical Sciences Division’s Standards, focusing on containment, contamination prevention, and real-time monitoring protocols for living cultures in microgravity bioreactors. These standards are expected to be further refined in 2025 in alignment with the agency’s goals for increased commercial utilization of low Earth orbit (LEO).

On the European front, European Space Agency (ESA) maintains its robust regulatory and support framework through the ISS utilization program and its forthcoming Low Earth Orbit Commercialization Initiative. ESA’s Bioreactor Express Service, operational since 2020, streamlines European and partner access to LEO for bioprocessing research, enabling standardized, compliant, and cost-effective mission planning. For 2025, ESA is emphasizing harmonization of bioreactor safety standards with NASA, facilitating joint experiments and cross-certification of hardware.

International collaboration is exemplified by ongoing joint missions and shared use of ISS modules, such as the ESA-developed Columbus laboratory, which continues to host advanced bioreactor systems and international payloads. Recent projects, including the Microgravity Investigation of Cement Solidification (MICS) and the continuous operation of ESA’s Kubik incubator, provide regulatory templates and operational data that inform future guidelines for bioreactor deployments.

- Regulatory harmonization is a priority for agencies aiming to enable seamless multi-agency utilization of orbital platforms, with a focus on data sharing, biosecurity, and intellectual property management.

- NASA’s Artemis program and ESA’s Gateway contributions are anticipated to extend the reach of microgravity bioreactor research beyond LEO, necessitating new safety and logistics protocols for deep space missions.

- Both agencies are engaging with commercial partners to define certification requirements for private bioreactor platforms, with the aim of fostering a competitive LEO economy by the late 2020s.

Looking ahead, the regulatory environment in 2025 is expected to be characterized by greater agility, increased transparency in standard-setting, and deeper international cooperation—all essential for advancing the field of microgravity bioreactor engineering and realizing its industrial and biomedical potential.

Technical Challenges: Scale-Up, Automation, and Quality Control

Microgravity bioreactor engineering faces a rapidly evolving landscape in 2025, driven by advances in biomanufacturing ambitions and increasing commercial engagement in low-Earth orbit (LEO). However, technical challenges persist, particularly in scaling up processes, automating operations, and ensuring rigorous quality control under unique microgravity conditions.

Scale-Up in microgravity bioreactors presents significant hurdles. While laboratory-scale systems—such as those utilized by NASA and the European Space Agency (ESA)—have demonstrated the basic feasibility of culturing cells and tissues in orbit, moving to industrially relevant volumes is non-trivial. Fluid dynamics are fundamentally altered in microgravity, complicating mixing, gas exchange, and nutrient delivery. Companies like Redwire Corporation are piloting modular, closed-system bioreactors designed for the International Space Station (ISS), yet current systems operate at milliliter to liter scales, insufficient for most commercial applications. Over the next few years, advancements are anticipated in the development of bioreactors with higher throughput, improved scalability, and adaptive fluid handling systems that leverage active mixing and perfusion technologies.

Automation is critical for microgravity operations, where crew time is limited and interventions are costly. In 2025, automation solutions are evolving quickly. Commercial platforms like BioServe Space Technologies and Sierra Space are integrating smart sensors, remote monitoring, and robotic handling to minimize manual operations. Autonomous control of environmental parameters (e.g., temperature, pH, dissolved oxygen) and real-time feedback systems are becoming standard, but reliable long-duration operation with minimal human oversight remains a challenge. The next few years will likely see increased collaboration with robotics specialists and AI-driven control systems to further reduce crew demands and increase process robustness.

- Quality Control demands new paradigms in microgravity, where contamination risks, batch consistency, and process reproducibility are heightened concerns. Companies such as SpacePharma are deploying compact, self-contained analytical modules capable of in situ monitoring and sampling. The lack of standard gravity-driven separation methods (e.g., centrifugation) necessitates the use of alternative techniques, such as acoustic or magnetic separation, to ensure product purity. In the near term, ongoing efforts are focused on validating these technologies against terrestrial standards and integrating real-time quality assurance protocols to meet the regulatory expectations of both space and Earth-based markets.

In summary, while 2025 marks a period of active innovation and deployment in microgravity bioreactor engineering, the field must overcome persistent scale-up, automation, and quality control challenges. Progress will depend on multidisciplinary collaborations and the adaptation of terrestrial bioprocessing advances to the space environment, with significant technological milestones expected in the coming years.

Future Outlook: Next-Gen Bioreactors and the Path to Commercialization

Microgravity bioreactor engineering is rapidly evolving as a cornerstone technology for space-based biomanufacturing and tissue engineering. As we enter 2025, the sector is characterized by strategic investments, expanding partnerships, and the maturation of hardware platforms explicitly designed for use in microgravity. The next several years are poised to witness a transition from proof-of-concept experiments to scalable, commercially viable bioreactor systems, driven by both governmental and private sector engagement.

Recent events highlight this acceleration. NASA’s ongoing Biological and Physical Sciences research roadmap includes the deployment of advanced bioreactor modules aboard the International Space Station (ISS), focusing on stem cell expansion and tissue maturation under microgravity. These efforts are complemented by the ISS National Laboratory’s sponsorship of commercial payloads, enabling startups and biotech firms to test next-generation reactors in orbit. Notably, Redwire Space has announced the expansion of its on-orbit BioFabrication Facility (BFF), which is anticipated to support more complex tissue and organoid projects in 2025 and beyond.

On the industry front, SpacePharma is advancing miniature, fully automated microgravity bioreactor platforms, targeting pharmaceutical R&D and personalized medicine. Their recent launches demonstrate considerable progress in remote-managed bioprocessing, optimizing cell culture conditions and monitoring in real-time from Earth. Airbus is also developing scalable bioreactor concepts under its Space Factory initiative, envisioning modular production units for cell therapies and biomanufacturing to meet both space exploration and terrestrial healthcare needs.

Looking forward, commercialization will hinge on several factors. Cost reduction in launch and operations, led by reusable vehicles from SpaceX and new cargo platforms, will make regular deployment of bioreactors more feasible. Additionally, regulatory frameworks for space-manufactured biomedical products are beginning to take shape, with agencies collaborating to establish standards for product safety and traceability.

By 2027, it is expected that hybrid ground-orbit production pipelines will be routine, with microgravity bioreactors delivering unique cellular products—such as highly organized tissues and rare biologics—that are challenging or impossible to obtain on Earth. As industry and agency partnerships deepen, the field is moving toward scalable, autonomous, and commercially robust microgravity bioreactor engineering, marking a pivotal step in creating a viable space-based bioeconomy.

Sources & References

- NASA

- Redwire Corporation

- Techshot (a Redwire company)

- Nanoracks

- Airbus

- European Space Agency (ESA)

- Axiom Space

- SpacePharma

- Blue Origin

- Merck & Co., Inc.

- Eppendorf SE

- Sartorius AG

- Concurrent Technologies Corporation

- Voyager Space